LEARN — Education Hub

A clear, trusted space to understand how the Digital Banker™ system works — from the philosophy behind self-banking to the legal structures that make it possible.

A clear, trusted space to understand how the Digital Banker™ system works — from the philosophy behind self-banking to the legal structures that make it possible.

Self-banking is the modern alternative to traditional banking. Instead of depositing your money into a bank — where they put it to work and they keep the earnings — you keep control of your funds and use Digital Banker™ to run the same basic playbook banks have used for decades: • Turn incoming cash into appreciating assets • Borrow against those assets when you need liquidity • Pay expenses from that liquidity • Refill and repeat. The difference is simple: With banks, that engine builds their balance sheet. With Digital Banker™, it builds yours.

Traditional banking: • You deposit → the bank invests or lends • The bank earns the real spread • You typically earn ~1% in a "high-yield" savings account • The bank earns multiples of that. Self-banking with Digital Banker™: • You deposit → you acquire structured, appreciating assets • You access liquidity through DB instead of draining your assets • You keep the benefit of the growth • Your money stays under your control, not locked in a bank's balance sheet. Money hasn't been the problem. The system has. Self-banking is how you step out of that system.

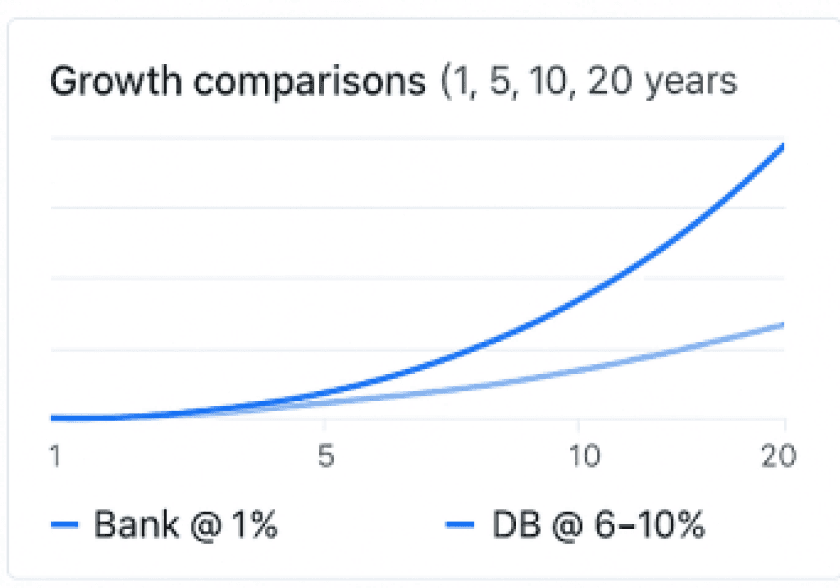

This isn't about taking more risk — it's about removing the drag of letting a bank earn what you should be keeping. Use a simple comparison: ... see more ● Traditional savings account: ~1% annual yield ● Digital Banker™ assets: modeled growth of up to ~10% (for example, ~6.7% tied to long-term real-estate indices plus additional Rewards benefits in some cases) 10% isn't just "9% more. 10% is 10 times 1% — which means: ● 1% = your baseline ● 10% = 1,000% of the original (10×). So when we say "up to 1,000% better than savings," we're describing a 10× performance multiple compared to a 1% savings yield — not a gimmick, just math.

Banks have always understood two things: • The cost of capital (what they pay you) • The yield on capital (what they earn using your money). Example: • You: earn ~1% on deposits • Bank: deploys your deposits at 6–20%+ across loans and other instruments. They capture the spread. You get the crumbs. With Digital Banker™: • You take the place of the bank in this equation • Your incoming cash becomes the asset base • Your liquidity needs are handled by DB's internal mechanics • You stop donating the spread to someone else's balance sheet. Compounding doesn't change — who it benefits does.

This section is the anchor for anyone asking: "Is this safe?" "Is this legal?" "Are these securities?" "Where is my money actually held?"

Digital Banker™ assets — including REDs, GDs, DBRs, and SoGlo-related units — are deliberately structured not to function as securities.

Understand

Aligned with: • Securities principles • Money transmission rules • Tax clarity • Data protection Not "trust the magic" — everything has clear logic, purpose, and behavior.

You own the engine. Banks just rent you a seat.

Compare bank savings vs. DB-style growth

Compare bank savings vs. DB-style growth

This is the gap between letting the bank earn the spread vs. keeping if yourself. $12.480 difference over 10 years

The answers that matter. Direct. Complete. No hedging.

Reach out to our legal team for detailed documentation.